Consumer prices in China stagnate in 2024 amid weak demand

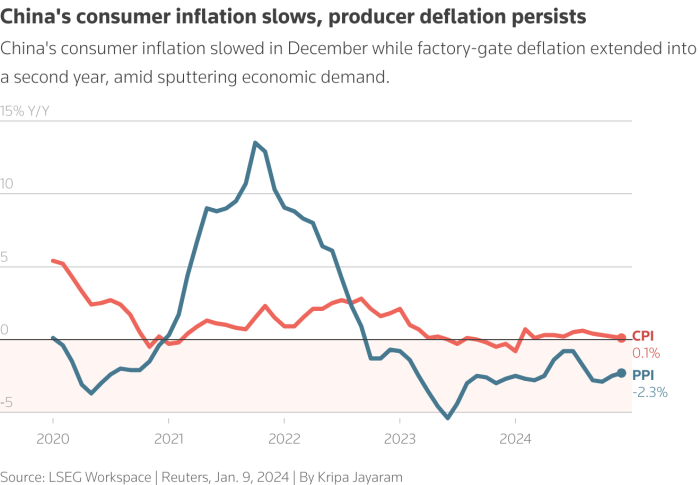

BEIJING: China’s consumer prices remained stagnant in 2024, reflecting weak domestic demand, while ex-factory prices extended their deflationary streak for the second consecutive year, according to official data from the State Bureau statistics.

Key economic indicators

- Consumer Price Index (CPI):

The annual CPI increased by only 0.2%in line with 2023 figures, well below the government’s 3% target. The December CPI increased slightly by 0.1% over one year, the lowest since April, in line with analysts’ forecasts. - Core inflation:

Excluding volatility in food and energy prices, underlying inflation reached 0.4% in December, the highest in five months, reflecting slight upward pressure on demand. - Producer Price Index (PPI):

The December PPI decreased by 2.3%marking 27 consecutive months of deflation, although showing a slower rate of decline than November 2.5%.

Economic and political context

Consumer demand has been weakened by job insecurity, a persistent housing downturn, rising debt and trade uncertainty as the new US administration of President-elect Donald Trump reignites related tensions. to customs duties. Despite Beijing’s aggressive stimulus measures, including a record $411 billion Due to special Treasury bond issues and increased fiscal spending, deflationary pressures persist.

Industry and consumer trends

- A third year electric vehicle price war and wider discounts in the retail sector are holding back profit margins.

- Consumers are increasingly choose to rent rather than purchasing discretionary items, reflecting prudent spending behavior.

Expert analysis

Chinese economic official Julian Evans-Pritchard noted that stimulus measures are temporarily supporting prices, but expects underlying inflation to weaken later in the year. Zhang Zhiwei of Pinpoint Asset Management pointed to the unresolved slowdown in the real estate sector as a major drag on consumer confidence and inflation.

Outlook

The trajectory of inflation in China will largely depend on the success of fiscal policies aimed at restoring confidence. The government allocated 41 billion dollars to subsidize trade in consumer goods and equipment upgrades and is set to increase funding for ultra-long-term Treasury bonds in 2025 to boost investment and consumption.

Conclusion

Although short-term stimulus measures have provided only limited relief, persistent structural challenges continue to cloud China’s inflation outlook, with domestic demand and a recovery in the real estate sector remaining key to stability. future economy.